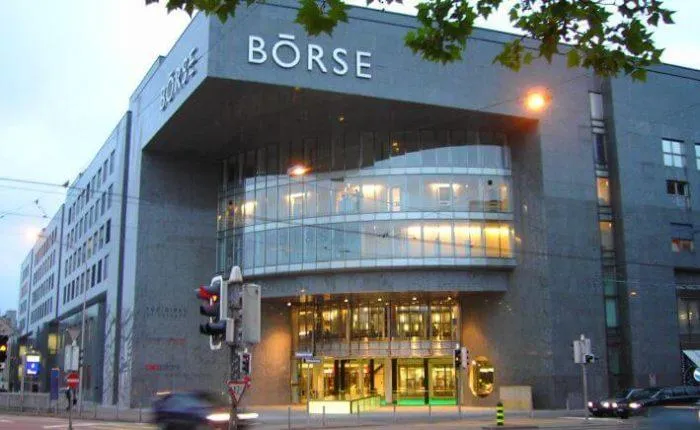

Switzerland Stock Exchange

For anybody who is looking to diversify their portfolio or increase their liquidity, stock loans are an excellent way to go.

Loans Against SIX Listed Securities

They are one of the most popular methods for small-cap shareholders and investors to diversify their portfolio while increasing their liquidity. This combination can work well for a variety of situations.

Schedule your 15-minute phone call with us today!

About Swiss Stock Exchange (SIX)

SIX, or the Swiss Exchange, is the primary securities exchange for Switzerland. The Swiss Stock Exchange is based in Zurich and is where securities including equities, stock options, government bonds, and other Swiss government bond derivatives trade.

Formed from the SIS Group, the Telekurs Group, and the SWX Group, the stock exchange adopted its current name of the SIX Swiss Exchange in 2008. Securities on the SIX Swiss Stock Exchange trade in CHF, or the Swiss franc.

General Purpose Loan vs. Margin Loan

Our rates are very competitive compared to traditional margin loans!

| $25K | $50K | $100K | $500K | |

| Stock Loan Solutions | 10.000% | 9.000% | 8.000% | 7.000% |

| E-Trade | 13.700% | 13.200% | 12.700% | 12.200% |

| Fidelity | 13.075% | 12.125% | 12.075% | 11.825% |

| Charles Schwab | 13.075% | 12.125% | 12.075% | 11.825% |

How Our SIX Stock Loans Work

Stock loans, also referred to as securities-based lending, gives you access to the cash you need to pay off expenses, pay down debt, and diversify your portfolio while you maintain ownership of your shares. All you need to get access to these loans is shares of a publicly traded company listed on the Swiss Stock Exchange (SIX).

About Switzerland

Switzerland is officially referred to as the Swiss Confederation and is a landlocked European country. It is bordered by Austria, Liechtenstein, France, Germany, and Italy. Geographically, Switzerland is divided between the Alps, the Jura, and the Swiss Plateau. The Swiss population size is around 8.5 million and largely concentrated on the plateau, as this is where most of the economic centers and bigger cities are located, despite the Alps occupying a large portion of the territory.

Switzerland has four national languages, although German is spoken by the majority of the population (62.8%). The other official languages are French in the west (spoken by 22.9%), Italian in the south (spoken by 8.2%), and Romansh (spoken by only 0.5%). The Swiss federal government is required to provide communication in all of the official languages.

Interested in a Swiss stock loan?

Call us at +1 866-446-1009

Or email us at [email protected]

Check whether you qualify

Deals can be closed within 48 hours

Swiss Stock Loans Explained

Here’s more information about how our Swiss stock loans work.

Hassle-Free – No Credit Checks

Secured by your SIX stock portfolio, you can rest assured knowing you will not need a credit check for your loan. Your loan package is handled by our in-house underwriting team . Our team is proud to provide highly individualized service to each of our clients. As a result, communication between us and our clients is more straightforward and efficient.

Impressive Loan to Value (LTV) Ratios

Depending on stock price, trading volume, and how many shares you own, your loan amount can vary. We also take market conditions and the stock’s historical performance into consideration when determining your loan amount. Our LTV ratios are quite competitive. and they are typically in the range of 45% to 60%.

Non-Recourse Financing

You won’t be personally liable for your loan because your shares fully secure your loan. You will not be required to provide any personal guarantees like you would with a standard margin loan.

Efficient Closing and Funding

With our in-house underwriting team, our transactions close much more efficiently compared to other stock loan lenders. With other lenders, it can take as long as two or three weeks for loans to fund. At Stock Loan Solutions, we can get you the funding for your loan and close as quickly as 4 to 6 business days. These funds will be directly wired to your own bank account.

Affordable Interest Rates and Adaptable Terms

With loan terms ranging from 24 to 60 months, our competitive rates are worth checking out. Our interest rates are based on the current prime interest rate. The sooner you start the application process for your loan, the better chance you have of locking in the best rate. Every loan we close has a quarterly interest rate payment schedule.

Guaranteed Confidentiality

Your privacy is very important, which is why we maintain absolute confidentiality and privacy during your transaction. All of your information will be stored on secured servers that use state-of-the-art software for encryption.

Ready to Get Started with a Swiss Stock Loan?

Applying for and closing a stock loan can be an intimidating process. Fortunately, our team of experts at Stock Loan Solutions is here to guide you through each step along the way. Our team will use their combined experience to make sure you are getting the best value for your loan.

In order to qualify for a Stock Loan Solutions stock loan, you will need:

Shares that trade on the SIX

Stock that is free of restrictions

Schedule a free 15-minute phone consultation through the button below!

The information contained herein is presented solely for the purposes of discussion and under no circumstances should this be considered an offer to buy or a solicitation of an offer to sell any security. Stock Loan Solutions is not a registered securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. Stock Loan Solutions, its managers or affiliates have not been registered and do not plan to be registered under the Investment Advisers Act of 1940 or any similar state or foreign securities laws. Stock Loan Solutions is not registered under the Investment Company Act of 1940 or under any similar state or international securities laws. Stock Loan Solutions does not offer any form of investment (buy or sell) advice, tax counseling, estate planning, or any other securities or financial advice whatsoever. No statements on this website or any verbal or written statement by any representative shall be construed as such advice. We are neither licensed nor qualified to provide investment advice.

We take protecting your data and privacy very seriously. Do not sell my personal information.

© 2025 Stock Loan Solutions